U.S. natural gas futures closed lower on Friday, retreating from earlier gains as market sentiment turned bearish. The March Henry Hub contract settled at $3.422 per million British thermal units, marking a decline of approximately 2.5% for the session.

Weather and Supply Factors Drive Volatility

Prices came under pressure following updated weather projections indicating warmer conditions ahead. This shift follows recent extreme cold that had previously driven prices higher. The market remains highly sensitive to temperature forecasts, with each adjustment directly impacting trading activity.

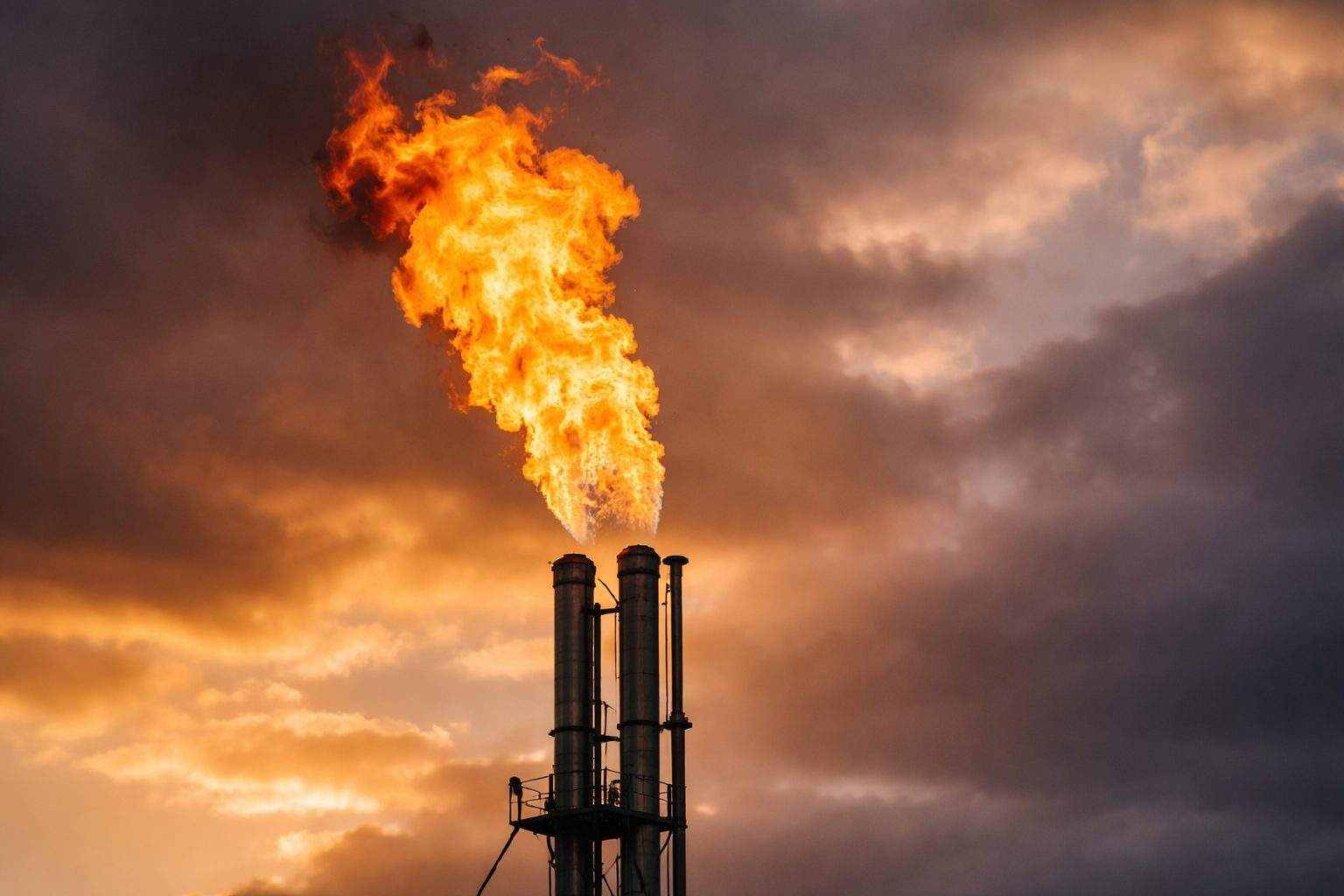

On the supply side, recent data shows increased drilling activity. The Baker Hughes rig count rose to 130 for the week ending February 6, up from 125 the previous week. This uptick in production capacity adds to the downward pressure on prices.

Storage Drawdown Provides Counterbalance

The Energy Information Administration reported a substantial withdrawal from storage last week, with inventories decreasing by 360 billion cubic feet—the largest weekly draw on record. This leaves current stockpiles approximately 1.1% below the five-year average for this period.

Looking ahead, traders are focusing on several key developments: mid-February weather models, the next storage report due February 12, and ongoing LNG export dynamics. Cheniere Energy has filed for regulatory approval to expand its Corpus Christi facility, which would require approximately 3.3 billion cubic feet of gas daily if approved.

European markets are also influencing global sentiment, with Dutch TTF futures recently showing significant volatility. European buyers continue seeking long-term supply agreements, with one Greek joint venture currently negotiating for U.S. LNG contracts to secure future supply.

The market now faces competing narratives: bearish pressure from improving weather and rising production versus supportive factors including tight storage and strong export demand. The direction of prices in the coming week will likely depend on which of these forces gains dominance.