Tencent Holdings Ltd (0700.HK) saw its shares decline 2% to HK$547.50 in Friday's Hong Kong session, aligning with a broader 1.1% retreat in the Hang Seng TECH Index. The downturn reflects investor apprehension surrounding new regulatory scrutiny on artificial intelligence and ongoing challenges in the semiconductor supply chain for data centers.

Regulatory and Supply Chain Headwinds

Chinese authorities have issued a warning regarding potential security vulnerabilities associated with the OpenClaw open-source AI agent. Tencent Cloud is among the service providers offering access to this technology. While no ban was announced, the industry ministry urged organizations to enhance security audits and access controls for such deployments.

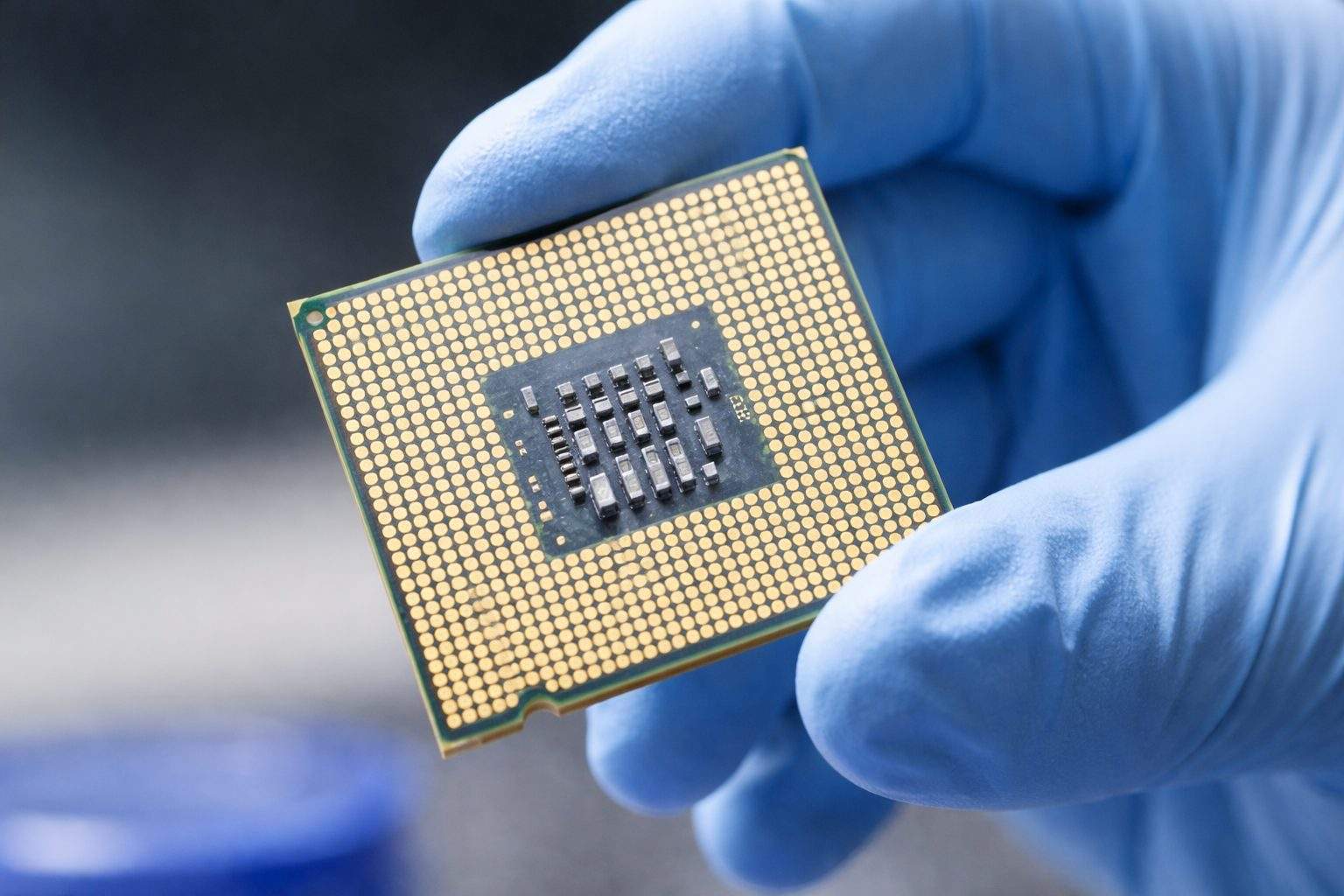

Concurrently, hardware supply issues are emerging. Reports indicate that Intel and AMD have alerted customers in China to anticipate extended delays for server central processing units (CPUs), with some Intel shipments potentially facing wait times up to six months. Sources suggest prices in the region have increased by over 10%. Intel anticipates inventory reaching its lowest point in the first quarter before improving, while AMD expressed confidence in meeting demand.

Broader Market Context and Company Focus

The pressure on Tencent, a bellwether for China's internet sector, was compounded by cautious sentiment spilling over from volatile U.S. technology stocks. Analysts note that even minor regulatory or cost changes can significantly impact expectations for Tencent's cloud and advertising revenue streams.

Despite the market decline, Tencent continues its share repurchase program. Regulatory filings show the company canceled 16.53 million shares in January, ending the month with approximately 9.106 billion shares outstanding after accounting for new shares issued from employee option exercises.

Looking ahead, market participants are monitoring for further regulatory guidance on AI deployments and signs that chip shipment delays may hinder data center expansion. Sentiment will also be influenced by the performance of U.S. tech equities. Tencent is scheduled to report its fourth-quarter and full-year 2025 financial results on March 18.