The Dubai Financial Market (DFM) experienced a subdued trading session on Friday, with shares of the exchange operator itself declining 0.6% to close at 1.65 UAE dirhams. The broader market benchmark, the DFM General Index, retreated 0.3% to settle at 6,590.53 points. Total trading value for the session reached 734.2 million dirhams, according to official exchange data.

Market Context and Geopolitical Headwinds

The decline occurred against a backdrop of escalating geopolitical friction between the United States and Iran. Market participants reacted to reports that U.S. President Donald Trump had issued Tehran an ultimatum, demanding limits on its nuclear program within a 10 to 15-day window. This development injected fresh uncertainty into regional markets, which are particularly sensitive to Middle Eastern tensions.

Concurrently, global oil prices, a critical driver for Gulf economies, edged lower. Brent crude slipped 0.4% to $71.38 per barrel. The dual pressure of geopolitical risk and softer energy prices created a risk-off environment, dampening investor appetite for regional equities. The trading session on Thursday had seen a more pronounced sell-off, with Dubai's benchmark index falling 2.3%.

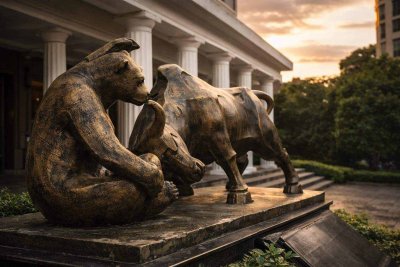

The DFM as a Market Bellwether

DFM is not merely another listed company; it operates the stock exchange itself and handles critical post-trade operations. Consequently, its share price often serves as a barometer for local investor risk sentiment and can signal underlying shifts in trading activity and capital flows. The stock's performance is closely watched by market professionals for clues about the health of the UAE's financial ecosystem.

"Geopolitical headwinds continue to stall the momentum needed to sustain an upward trajectory," noted Milad Azar, a market analyst at XTB MENA. His comment underscores the fragile sentiment that has characterized recent sessions, where external political developments have overshadowed local fundamentals.

Corporate Disclosure and Trading Dynamics

Earlier in the week, on February 19, DFM disclosed that its board of directors had passed a resolution "by circulation," meaning members approved a decision outside of a formal meeting. The disclosure pertained to an internal company matter, with no specific details provided. While the nature of the resolution remains unclear, such corporate governance actions are routine but are monitored by investors for any significant strategic implications.

Friday's trading turnover, while active at over 734 million dirhams, still represented a decline from the previous session's volume. This suggests that despite the price movement, participation may have been tempered by caution ahead of the weekend market closure.

Weekend Gap and Forward Outlook

The market closure until Monday creates a significant "weekend gap" where international headlines can develop while regional prices are frozen. The key question for traders is whether the current volatility will attract fresh, opportunistic capital or continue to push investors to the sidelines.

The immediate direction for DFM shares upon Monday's reopening will likely hinge on developments over the weekend. A further escalation in U.S.-Iran tensions, coupled with additional weakness in oil prices, could extend the selling pressure and reinforce a risk-off posture. Conversely, any de-escalation in rhetoric or signs of diplomatic progress could help stabilize market sentiment and potentially trigger a technical rebound.

Investors will be watching for any shifts in the geopolitical landscape and their subsequent impact on global risk assets. The performance of the DFM and its listed entities remains intricately linked to these broader macro forces, highlighting the interconnected nature of Gulf financial markets with global politics and commodity cycles.